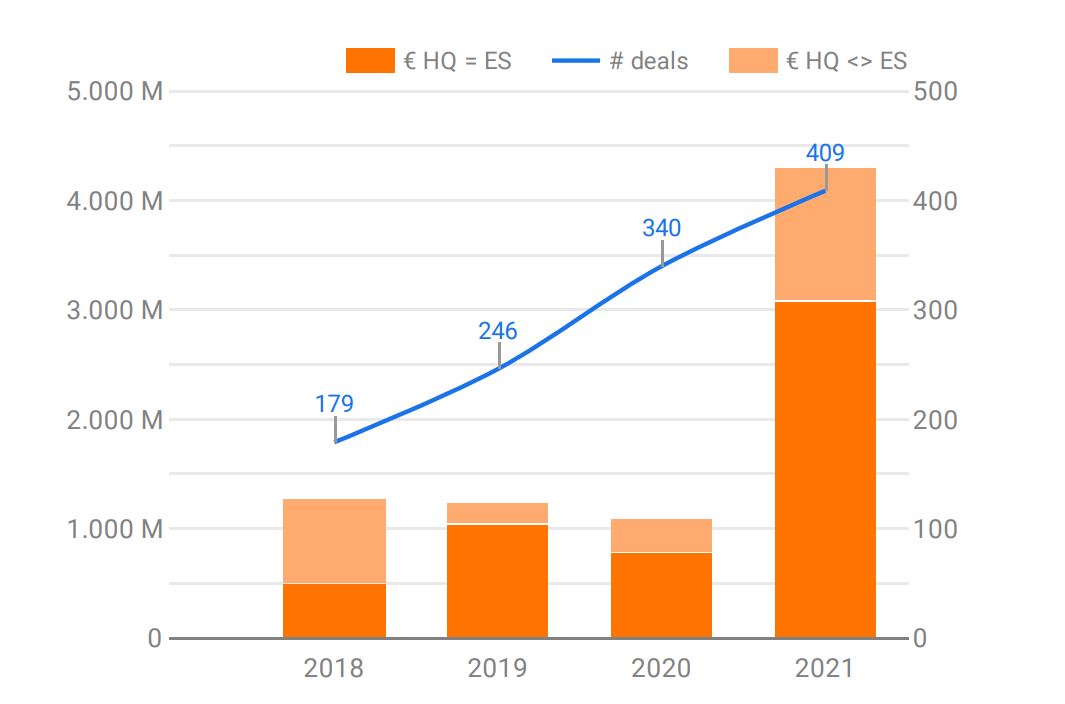

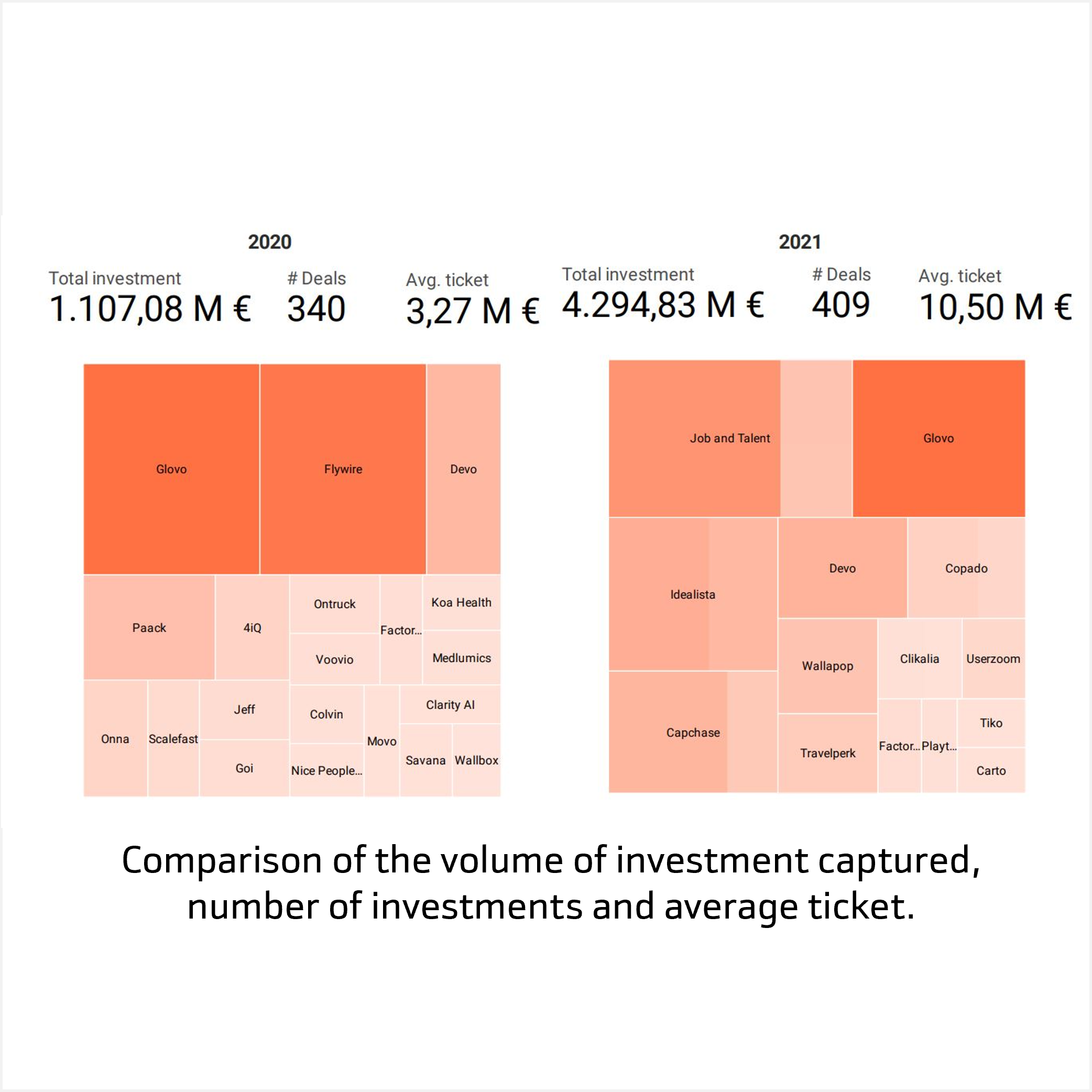

Investment volume has multiplied 4x compared to 2020, reaching €4.29 billion—the best figure in the historical series—thus confirming the excellent health of the ecosystem.

Annual report

Investment Trends in Spain 2021

Download PDF

Investment volume

Investment deals

Investment activity has increased by 20% (less than the increase in investment volume) indicating that deals are larger and the coming of age of the startup ecosystem in Spain.

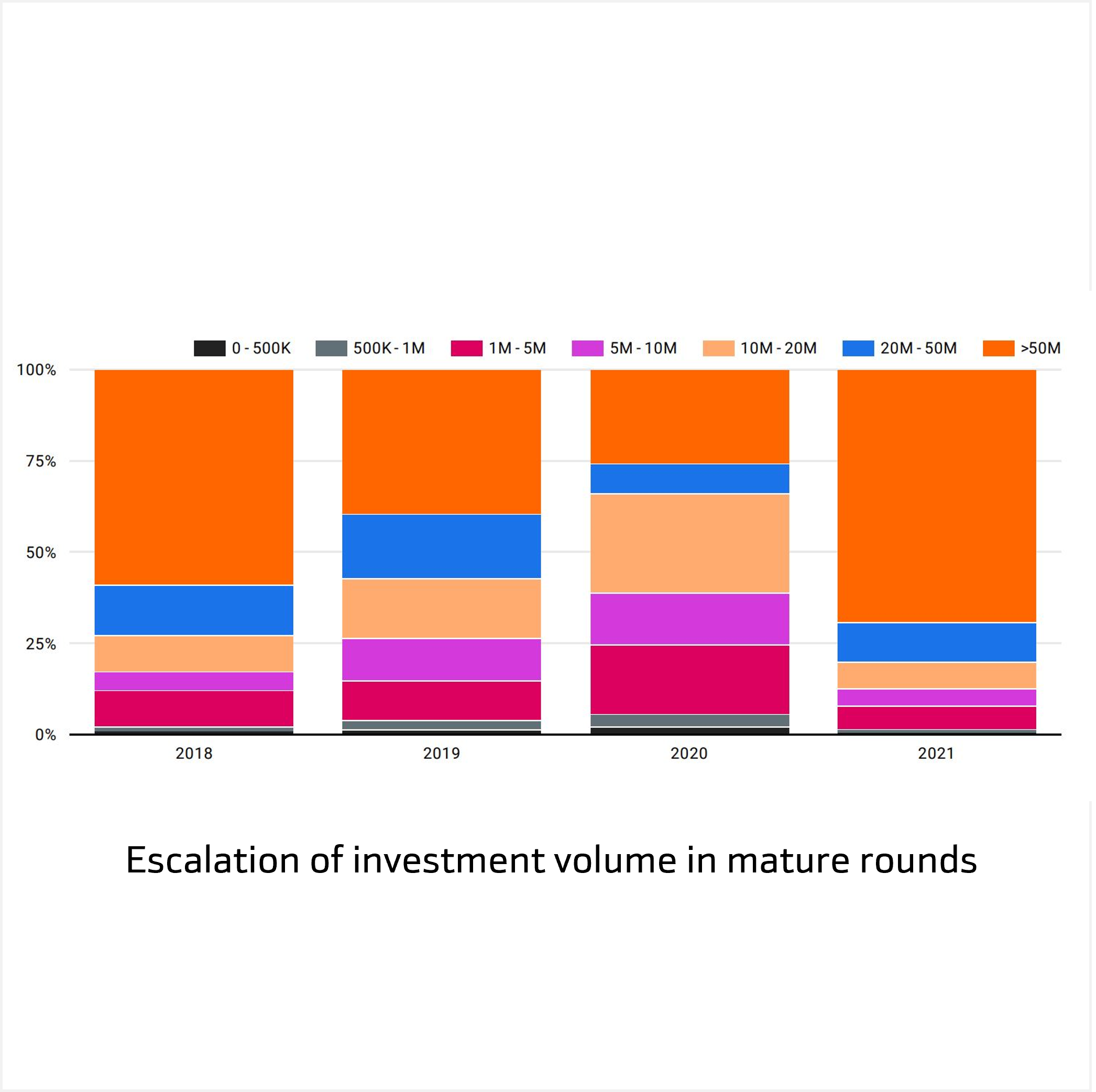

Investment rounds

The maturity of the Spanish startup ecosystem is demonstrated by the fact that the largest increase in investment is in Series C and later (6X vs 2020) but continues to expand as evidenced by the relevant growth in Series A and B (+22.9% and +17% respectively).

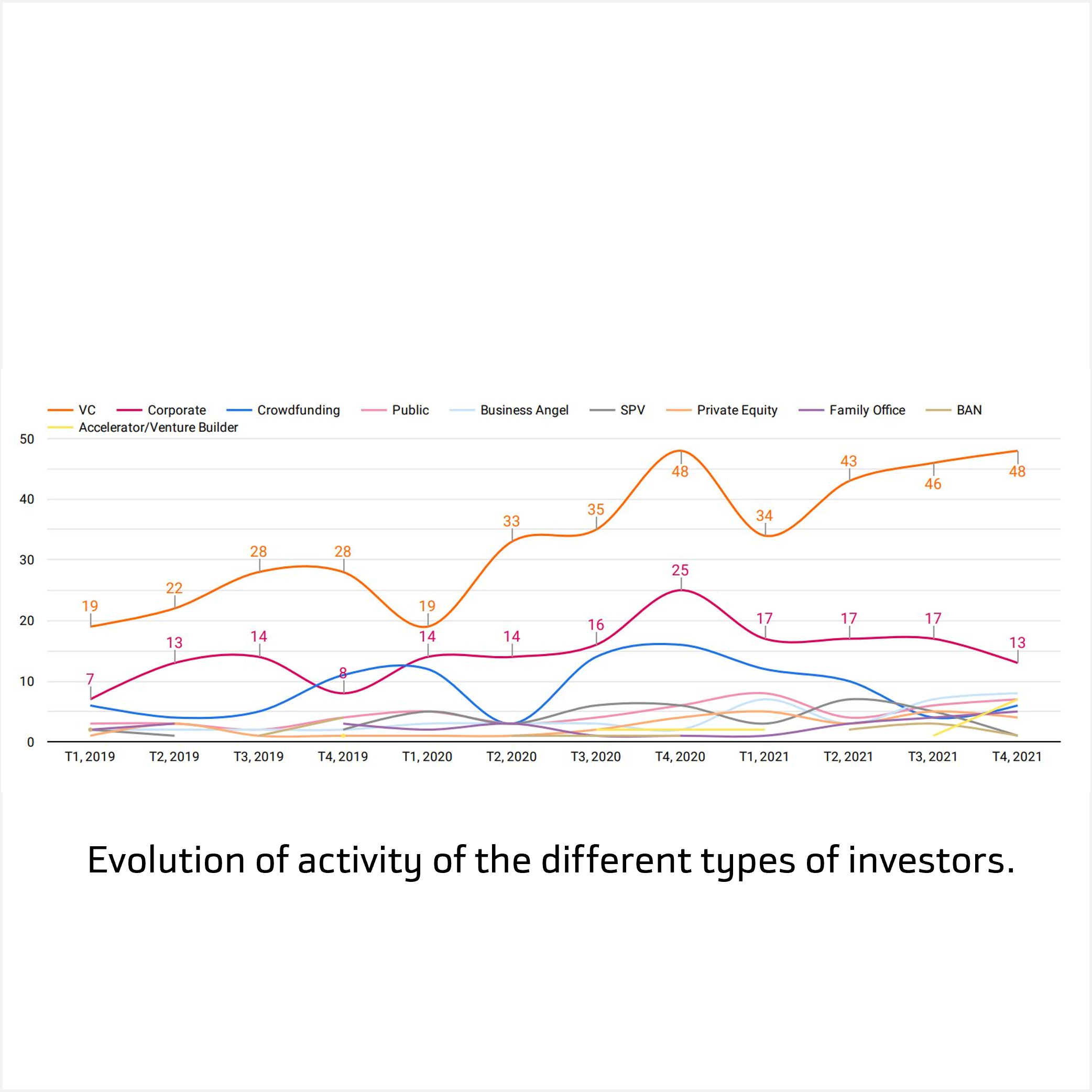

Inverstors

The most active player in investment in startups during 2021 was Venture Capital (VC) which has multiplied by 3.5 times what was invested in 2020: the rest of the investors are down slightly.

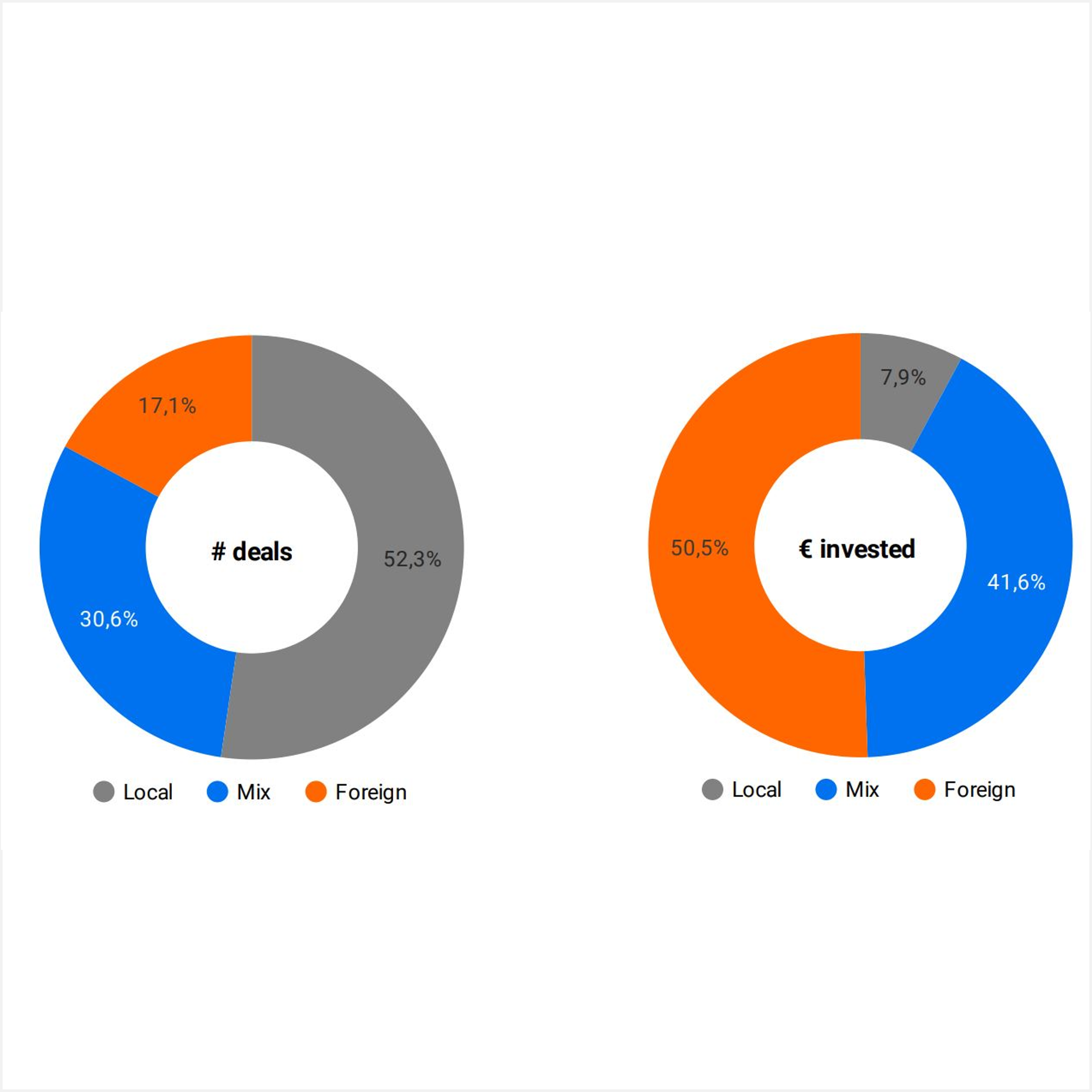

Foreign investment

Foreign investment funds have become a staple character of the Spanish startup ecosystem. The total stakes of foreign investment in Spanish startups amounts to €2.10 billion—they have expanded their investment by 335%.

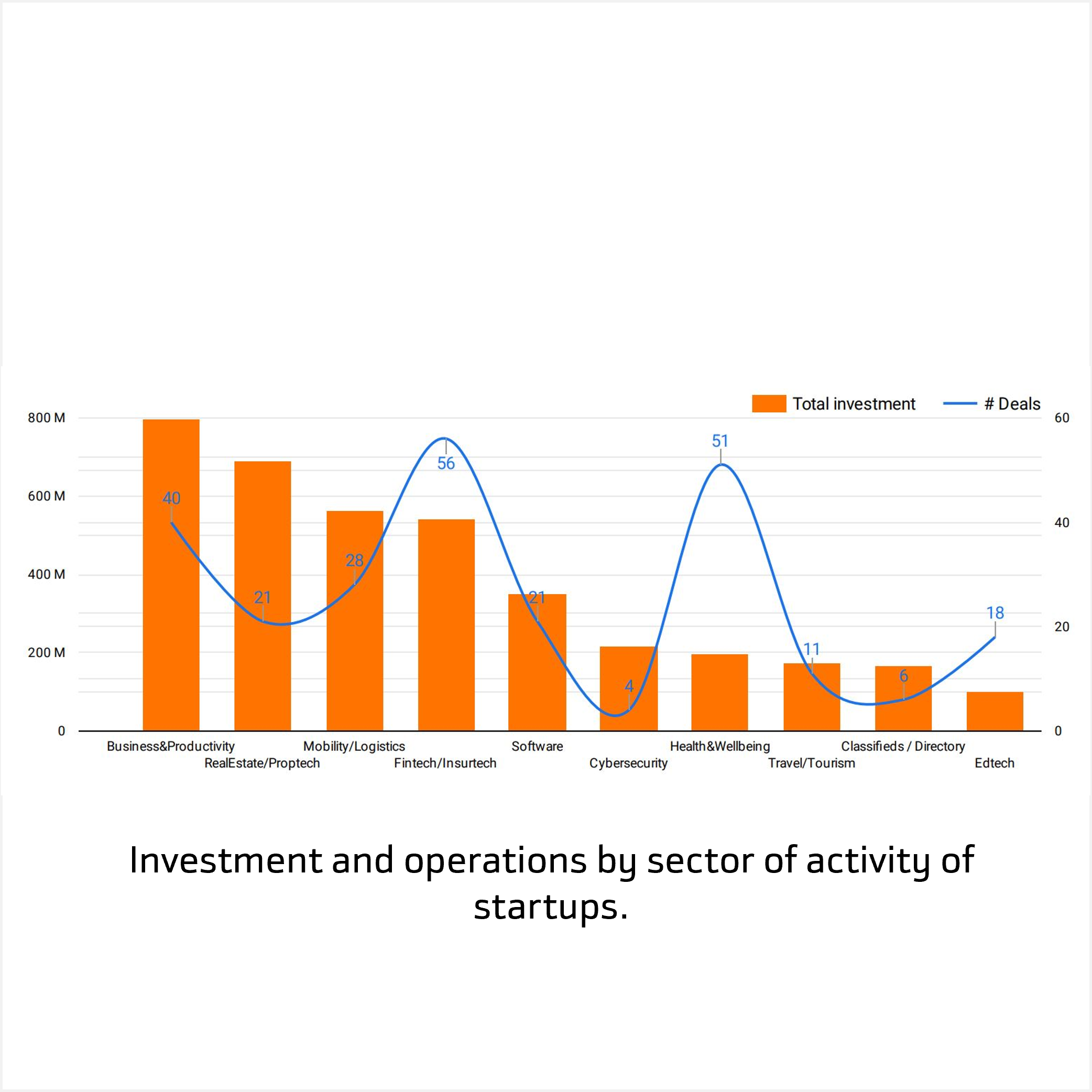

Sectors

Although investments have risen across all startup sectors, Real Estate & Proptech (+4,058%) and Software (+1,427%) stand out for their growth. Business & Productivity (which has grown by 599%) is the sector with the highest investment.

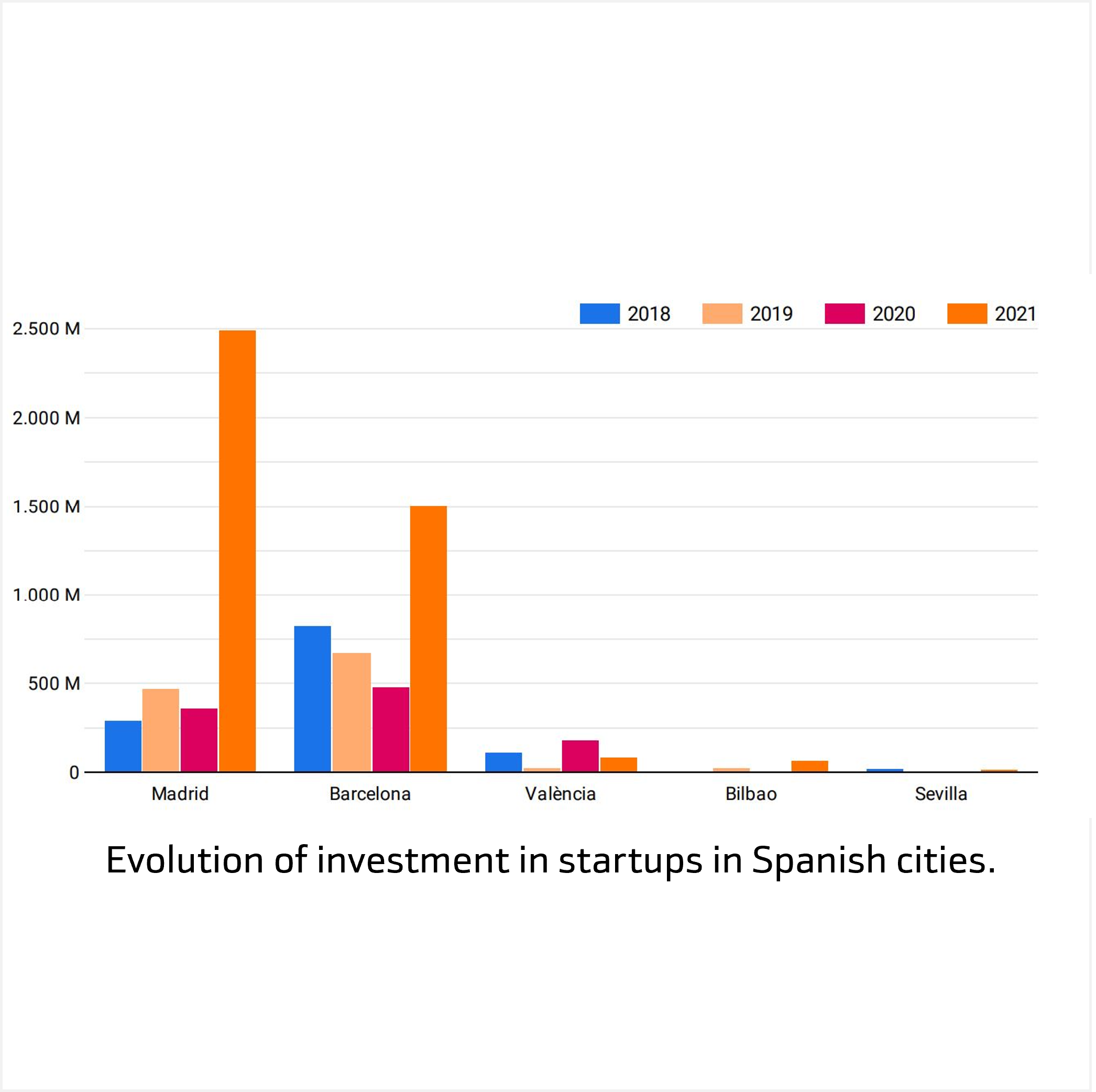

Location of startups in Spain

During 2021, Madrid’s leading position in the Spanish startup ecosystem was consolidated, overtaking Barcelona for the first time (€1.51bn vs. €2.48bn). This figure does not include Glovo’s recent M&A deal announced in 2022.

Barcelona still holds first place in terms of activity (144 vs. 133).